Industrial Mineral Grades: Which Is Best for Your Industry?

03 February, 2026

04 February, 2026

Global trade in industrial minerals and clay depends heavily on correct product classification. Whether exporting feldspar, ball clay, or other mineral-based raw materials, the correct HS Code for Industrial Minerals and HS Code for Clay plays a critical role in customs clearance, duty calculation, and regulatory compliance. HS codes act as a common international language that helps customs authorities identify goods accurately.

Using the correct HS code reduces shipment delays, avoids penalties, and ensures smooth cross-border transactions. Incorrect classification can lead to higher duties, rejected consignments, or legal complications. For exporters and importers, understanding HS codes is not just a compliance requirement but a key factor in building reliable and scalable international trade operations.

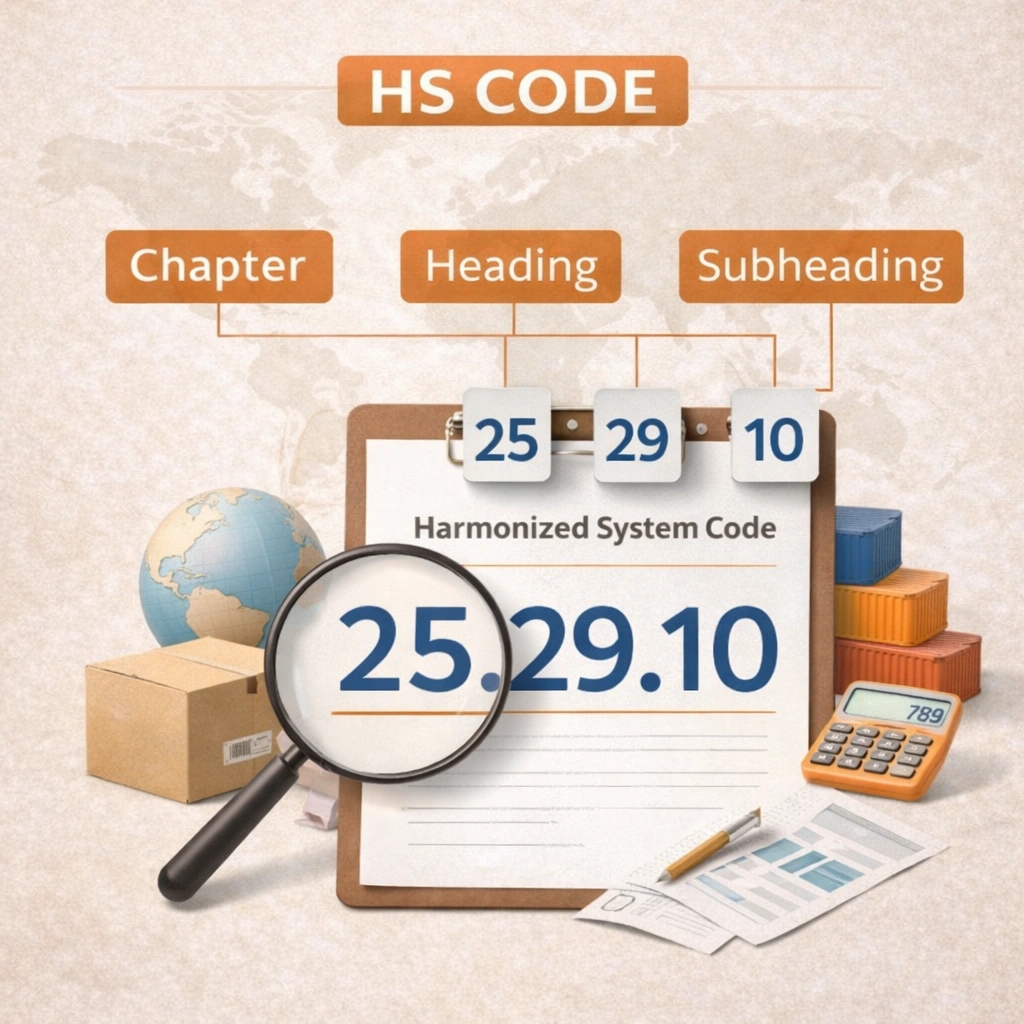

An HS code, or Harmonized System code, is an internationally standardized numerical system used to classify traded goods. Developed by the World Customs Organization, this system helps countries identify products uniformly for customs duties, taxation, and trade statistics. Every product involved in international trade, including industrial minerals and clay, must be assigned a valid HS code.

The HS code structure follows a global format. The first two digits represent the chapter, the next two digits define the heading, and the following two digits specify the subheading. Most countries use the six-digit system as a base and may add extra digits for national classification. Correct use of Export Import HS Code for Minerals ensures accurate documentation, faster clearance, and regulatory compliance.

Industrial minerals are non-metallic, naturally occurring materials used in manufacturing, construction, and processing industries. Under trade classification, minerals such as feldspar, quartz, clay, limestone, and similar materials qualify as industrial minerals when they are used for functional or commercial applications rather than metal extraction. Their classification depends on composition, intended use, and processing level.

These minerals are typically listed under mineral-related chapters in the HS system. Proper identification ensures that the product is aligned with internationally accepted trade categories.

Using the correct Industrial Mineral HS Code is essential for accurate customs declaration. HS codes determine applicable duties, taxes, and regulatory checks during export and import. An incorrect code can lead to shipment delays, penalties, or reassessment by customs authorities.

Accurate classification also helps maintain transparency in trade documentation and builds long-term trust with buyers and regulatory bodies.

The HS code for a mineral changes based on whether it is exported in raw, processed, or refined form. Raw minerals usually fall under basic mineral headings, while washed, ground, or chemically treated minerals may be classified under separate subheadings.

Understanding how processing alters HS classification helps exporters select the correct code and avoid misdeclaration.

A common mistake is using generic HS codes without considering processing levels or end use. Another error involves assuming the same HS code applies across all countries without verifying national extensions. Mislabeling mineral descriptions or ignoring technical specifications can also lead to incorrect classification.

Following a proper Mineral HS classification guide reduces compliance risks and ensures smooth export-import operations.

In international trade, clay refers to naturally occurring fine-grained earth materials composed mainly of hydrated aluminum silicates. Clay is widely traded for industrial applications such as ceramics, tiles, sanitaryware, refractories, and construction materials. Under HS classification, clay is identified based on its natural properties, composition, and intended industrial use.

Different types of clay may fall under different HS headings depending on purity and processing level, making correct identification essential.

Natural clay is clay in its raw, untreated form, usually extracted directly from mines. Processed clay may be washed, crushed, or ground to achieve uniform particle size. Refined clay undergoes further treatment to improve purity and remove impurities.

Each processing stage can change the applicable clay HS code, which is why exporters must clearly define the form of clay being shipped.

The Clay HS Code for Export Import is determined by clay type and processing level. Ball clay, china clay, and other clays may fall under different HS subheadings. Customs authorities rely on accurate product descriptions and HS codes to assess duties and regulatory requirements.

Using the correct code ensures smoother clearance and proper trade documentation.

An accurate Harmonized System Code for Clay ensures compliance with customs regulations and avoids shipment delays. Incorrect classification can lead to penalties, duty reassessment, or cargo detention.

For exporters and importers, precise HS coding supports transparent trade, predictable costs, and long-term business reliability.

Industrial minerals and clay are classified under different HS Codes depending on their type, purity, and processing stage. While the Harmonized System follows a global six-digit structure, exact classifications may vary slightly by country beyond this level. Below is an overview of commonly used HS Codes to help exporters and importers understand standard classifications.

|

Material Type |

Product Description |

Common HS Code Category |

|

Kaolin |

Natural or washed kaolin clay |

Chapter 25 – Mineral Products |

|

Ball Clay |

Plastic clay used in ceramics |

Chapter 25 |

|

Bentonite |

Swelling clay used in drilling and foundry |

Chapter 25 |

|

Feldspar |

Raw or processed feldspar |

Chapter 25 |

|

Quartz / Silica |

Natural quartz and silica sand |

Chapter 25 |

|

Limestone |

Crushed or ground limestone |

Chapter 25 |

|

Talc |

Natural or powdered talc |

Chapter 25 |

These entries form part of a broader Mineral HS Code List used in global trade. The final HS Code depends on factors such as mineral purity, moisture content, particle size, and whether the material has undergone processes like calcination, milling, or surface treatment.

The same mineral can fall under different Export Import HS Codes for Minerals when its physical form or chemical structure changes. For example, raw clay and chemically treated clay will not share the same classification. This makes accurate product identification essential.

Exporters should always ensure that invoices, packing lists, and shipping documents clearly describe the product. Proper alignment between product description and HS Code Industrial Mineral & Clay classification helps avoid customs disputes, reclassification, or penalties.

Identifying the correct HS Code for industrial minerals is a crucial step in export–import compliance. A structured approach helps reduce errors and ensures smooth customs clearance.

Identify the exact type of mineral being traded

Analyze the chemical composition and physical properties

Determine the level of processing, such as raw, washed, ground, or calcined

Match product characteristics with the relevant HS chapter, heading, and subheading

Verify the code using the official customs tariff schedule

The mineral’s composition directly affects its HS classification. The same mineral may fall under different HS Codes for Industrial Minerals based on purity or chemical treatment. End use also matters, as minerals used for industrial applications may be classified differently from those used for construction or other purposes.

Customs authorities provide official guidance on HS classification and can issue rulings in complex cases. Trade consultants and customs brokers help exporters interpret classification rules and avoid costly compliance mistakes.

Use detailed and accurate product descriptions

Ensure consistency across invoices and shipping documents

Stay updated on HS Code revisions

Seek expert advice when classification is unclear

Following these steps helps exporters avoid misclassification, reduce customs delays, and ensure regulatory compliance in international mineral trade.

Exporting or importing industrial minerals requires accurate and complete documentation to comply with international trade regulations. Proper paperwork ensures smooth customs clearance and helps avoid delays or penalties.

Commercial invoice with detailed product description

Packing list specifying quantity, weight, and packaging type

Bill of lading or airway bill

Certificate of origin

Shipping bill or bill of export

Any country-specific regulatory or quality certificates

HS Codes are a mandatory part of customs declarations. The correct HS Code for Industrial Minerals helps customs authorities identify the product, calculate duties, and apply relevant trade regulations. Incorrect HS Codes can lead to reassessment or shipment detention.

All export–import documents must consistently reflect the same HS Code. Any mismatch between invoices, packing lists, and shipping documents may raise compliance issues. Accurate industrial minerals export documentation aligned with the correct HS Code reduces the risk of customs queries.

Ensure uniform HS Code usage across all documents

Provide clear and detailed product descriptions

Follow country-specific customs regulations

Keep records for audit and verification purposes

Proper documentation combined with accurate HS classification supports efficient and compliant international trade of industrial minerals.

The export–import process for industrial minerals and clay involves multiple regulatory and logistical steps. Following the correct procedure helps ensure timely delivery and compliance with international trade laws.

Product identification and quality assessment

Selection of the correct HS Code for Industrial Minerals or HS Code for Clay

Preparation of export–import documentation

Filing customs declarations

Payment of applicable duties and taxes

Customs inspection and clearance

Shipment and delivery to the destination country

HS Codes play a central role at every stage of the export–import cycle. The correct Export Import HS Code for Minerals determines customs duty rates, regulatory requirements, and eligibility for trade benefits. Errors in HS classification can cause shipment delays or rejections.

Customs authorities verify product details, documentation, and HS Codes before granting clearance. Industrial minerals and clay may be subject to environmental, safety, or quality regulations depending on the destination country.

Use accurate and consistent HS Codes

Maintain complete and compliant documentation

Stay updated with import regulations of the destination market

Coordinate with experienced customs brokers

A well-managed export–import process helps mineral traders reduce risks, improve efficiency, and maintain compliance across international markets.

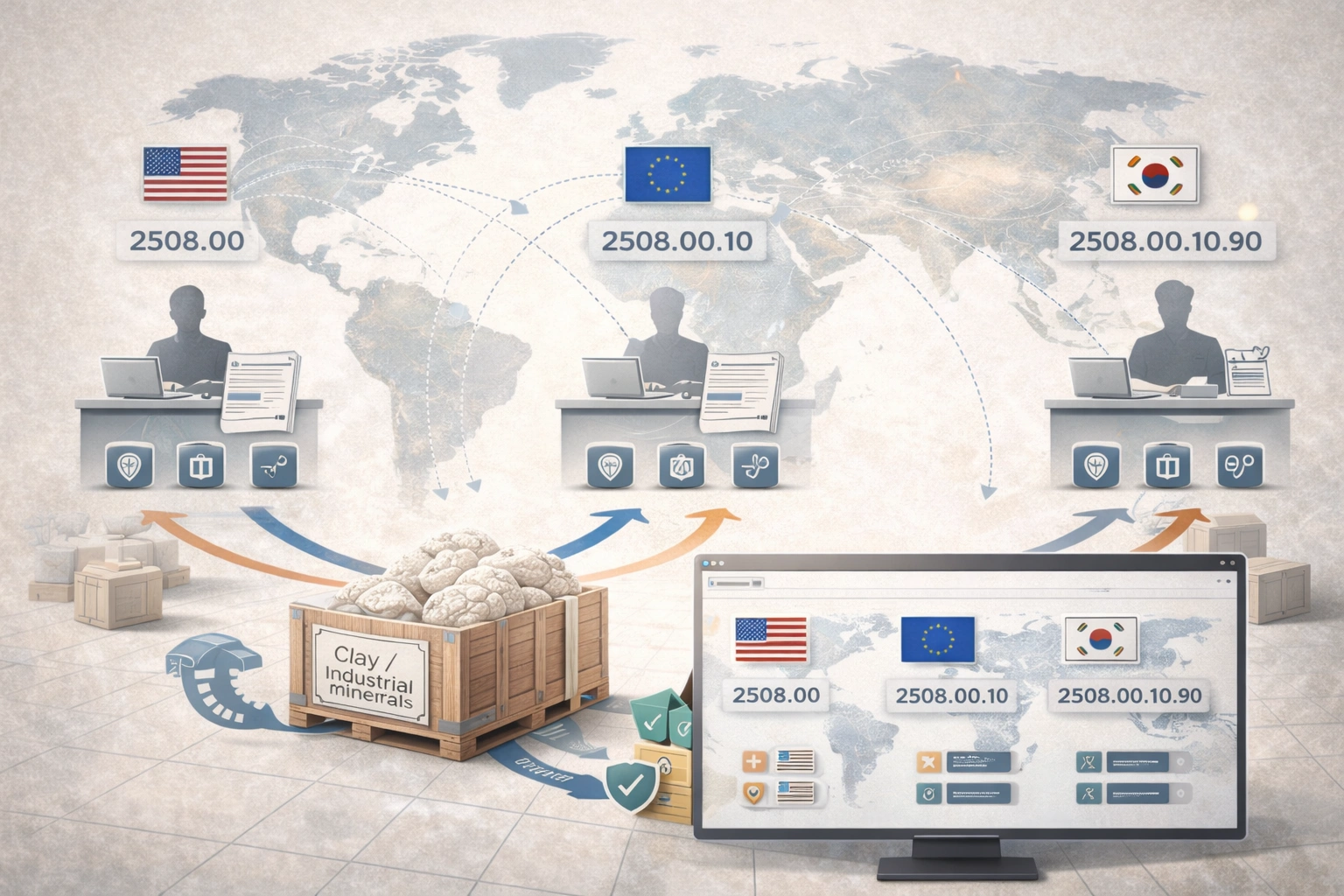

While the Harmonized System uses a standard six-digit HS code worldwide, many countries add extra digits for national classification. These additional digits help governments apply specific duty rates, regulations, or trade controls. Exporters of industrial minerals and clay must check destination-specific extensions before shipment.

Relying only on the six-digit code without verifying national subcodes can result in incorrect declarations.

Although the HS structure is globally standardized, interpretation of certain mineral products can vary by country. Customs authorities may classify minerals differently based on processing level, usage, or local regulations. What qualifies as one category in one country may fall under a different subheading elsewhere.

Understanding these regional differences helps exporters avoid disputes and reclassification.

The international trade code for clay must align with the importing country’s customs guidelines. Exporters should review tariff schedules, trade agreements, and import regulations of the destination market. Consulting customs brokers or local trade advisors can help ensure accuracy.

Correct alignment reduces the risk of delays and duty reassessment.

Exporters dealing with multiple international markets must maintain updated HS code records for each destination. This includes tracking country-specific HS extensions and regulatory changes.

A proactive approach to HS code management supports smoother exports, better compliance, and scalable global trade operations.

HS Code misclassification is one of the most common issues faced by exporters and importers of industrial minerals and clay. These mistakes can result in customs delays, penalties, or shipment rejection.

Many exporters use broad or generic HS Codes without considering the specific mineral type or processing level. This often leads to incorrect duty assessment and compliance issues.

The same mineral can have different HS Codes depending on whether it is raw, washed, ground, or chemically treated. Failing to account for these differences can cause misclassification under the HS Code for Industrial Minerals.

Inconsistent descriptions across invoices, packing lists, and shipping documents raise red flags during customs inspection. Accurate documentation must align with the selected HS Code.

HS Codes are revised periodically. Exporters who do not monitor updates risk using outdated codes, which can lead to regulatory non-compliance.

Use detailed and precise product descriptions

Verify HS Codes before shipment

Stay updated with HS Code revisions

Seek expert guidance when classification is unclear

Avoiding these errors ensures smoother customs clearance and strengthens compliance in international mineral trade.

Understanding the correct HS Code for Industrial Minerals and HS Code for Clay is essential for successful export–import operations. Accurate HS classification ensures compliance with customs regulations, correct duty assessment, and smooth international trade.

Industrial minerals and clay vary widely in composition and processing, making proper classification critical. Exporters who follow correct documentation practices, stay updated on HS Code changes, and verify country-specific requirements can avoid delays and penalties.

This Industrial Minerals Export Import Guide highlights the importance of accurate HS classification, proper documentation, and regulatory compliance. By applying these best practices, exporters and importers can strengthen trade efficiency, reduce risks, and maintain long-term compliance in global mineral markets.

The HS Code for industrial minerals depends on the mineral type, composition, and processing level. Most industrial minerals are classified under Chapter 25 of the Harmonized System, but the exact code varies based on the product description.

The HS Code for Clay varies according to the clay type, such as kaolin, bentonite, or ball clay, and whether it is raw or processed. Exporters must verify the correct Clay Export Import HS Code based on product specifications.

The first six digits of HS Codes are standardized globally. However, countries may add extra digits for national tariff and regulatory purposes, which exporters must check before shipping.

Yes, the same mineral may have multiple HS Codes depending on its form, purity, and processing stage. Accurate product description is essential for selecting the correct classification.

Exporters can avoid penalties by using detailed product descriptions, staying updated on HS Code revisions, and consulting customs authorities or trade experts when classification is unclear.

Whatsapp Chatx

Hi! Click one of our representatives below to chat on WhatsApp or send us email to [email protected]

|

Mr. RAJESH +91 99130 87000 |

|

Mr. JIGNESH +91 89800 70055 |